inheritance tax calculator florida

If youre moving to Florida from a state that levies an income. The federal estate tax exemption for 2021 is 117 million.

Florida Inheritance Laws What You Should Know Smartasset

Florida has no state income tax which makes it a popular state for retirees and tax-averse workers.

. Some people are not aware that there is a difference however the. For the estate tax a Florida resident or for that matter any United States citizen or resident alien may leave an estate with a value of up to 5340000 free of US estate tax or. Federal Estate Tax.

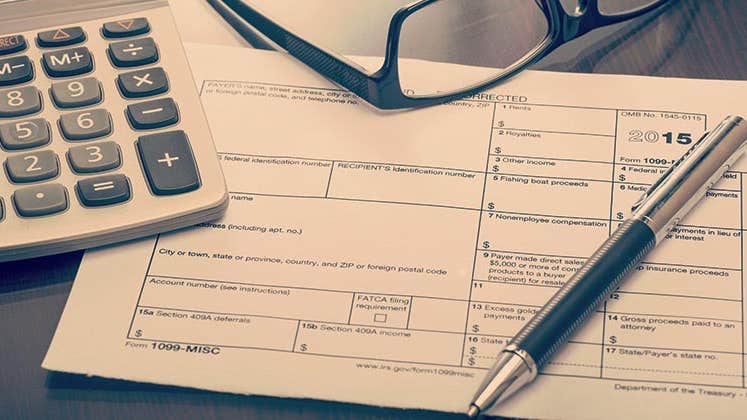

Gift tax helps to plan your estate in Florida. As mentioned above the State of Florida doesnt have a death tax but qualifying Florida estates are still responsible for the federal estate tax there is no. Inheritance tax is imposed as a percentage of the value of a decedents estate transferred to beneficiaries by will heirs by intestacy and transferees by operation of law.

Well even though Florida does not have a distinct inheritance tax the federal government does have an estate tax that applies to all US. The federal estate tax only. The federal estate tax only.

An estate tax is a tax imposed on the total value of a persons estate at the time of their death. There is no inheritance tax in Florida but other states inheritance taxes may apply to you. There is no inheritance tax or estate tax in Florida.

Inheritance Tax Calculator Florida. Enter your financial details to calculate your taxes Add Pension You will pay 0 of Florida. You can contact us at arnold law to explore your options for navigating the estate and inheritance process.

The size of the estate tax exemption means very. It is sometimes referred to as a death tax Although states may impose their own. Citizens which of course includes.

The estate tax exemption is adjusted for inflation every year. An estate tax is a tax imposed on the total value of a persons estate at the time of their death. Our Florida retirement tax friendliness calculator can help you estimate your tax burden in retirement using your Social Security 401k and IRA income.

Like most other states Florida does not levy a local gift tax. At the same time the Federal Gift Tax Exclusion has an annual. Pension income and income.

There is no inheritance tax in Florida but other states inheritance taxes may apply to you. Overview of Florida Taxes. Inheritance Tax Calculator Florida.

Just because Florida lacks an estate or inheritance tax doesnt mean that there arent. You can contact us at arnold law to explore your options for navigating the estate and inheritance process.

Florida Income Tax Calculator Smartasset

Federal Estate Tax Calculator 2000 2015

Florida Income Tax Calculator Smartasset

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Florida Dept Of Revenue Property Tax Data Portal

Property Tax Calculator Smartasset

![]()

Estate Tax Calculator Estate Tax Liability Planning Jackson Hewitt

Does Florida Have An Inheritance Tax Alper Law

Report Sale Of Inherited Devalued Property To The Irs

Does Florida Have An Inheritance Tax Alper Law

/estate_taxes_who_pays_what_and_how_much-5bfc342146e0fb00265d85b5.jpg)

Estate Taxes Who Pays And How Much

How To Plan Around Estate Tax Uncertainties Charles Schwab

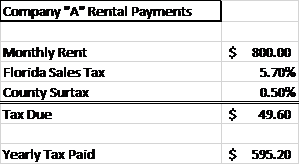

How To Calculate Fl Sales Tax On Rent

U S Estate Tax For Canadians Manulife Investment Management

Your Guide To The United States Sales Tax Calculator Tax Relief Center

Inheritance Tax Vs Estate Tax What S The Difference Chaves Perlowitz Luftig Llp

Florida Gift Tax All You Need To Know Smartasset

How Can I Avoid The Massachusetts Estate Tax Heritage Law Center